Recent Blog Posts

Is It Possible for Me to Have Sole Custody of My Child After a Divorce?

If you are a parent who is in the midst of a divorce, you probably have many questions about the future. “Where will I live?” “Will I be able to make enough money?” “What will happen to my kids?” As you probably know, the laws regarding child custody have undergone substantial changes in the last few years. The changes were designed to reduce competitiveness and friction between divorcing or unmarried parents and to encourage cooperative parenting. But what if your former partner is uninterested in taking responsibility for your child? Or, what if it scares you to leave your children with him or her? Fortunately, it is still possible for you to seek an amended version of what used to be called “sole custody” of your child.

If you are a parent who is in the midst of a divorce, you probably have many questions about the future. “Where will I live?” “Will I be able to make enough money?” “What will happen to my kids?” As you probably know, the laws regarding child custody have undergone substantial changes in the last few years. The changes were designed to reduce competitiveness and friction between divorcing or unmarried parents and to encourage cooperative parenting. But what if your former partner is uninterested in taking responsibility for your child? Or, what if it scares you to leave your children with him or her? Fortunately, it is still possible for you to seek an amended version of what used to be called “sole custody” of your child.

New Names for Legal Custody and Physical Custody

At the beginning of 2016, sweeping reforms to the Illinois Marriage and Dissolution of Marriage Act (IMDMA) took effect. The updates largely eliminated the term “child custody” and replaced it with the more nebulous phrase “allocation of parental responsibilities.” Under the amended law, parental responsibilities are divided into two primary areas. “Significant decision-making authority” replaced the previous concept of legal custody, and “parenting time” replaced the old idea of physical custody. Sole and joint custody were two different types of legal custody arrangements as they were established to clarify which parent or parents had the responsibility to make important decisions about the child’s life.

How a Special Needs Trust Can Protect a Disabled Loved One

When you consider what life will be like for your loved ones when you are not around to care for them, you may have serious concerns about family members who rely on you for the most care. You may have a child, a sibling, or even a cousin with a disability or other special needs. These needs may leave the person unable to adequately look after themselves. If you have been caring for a person with special needs, your death could lead to serious challenges for him or her, and your best option may be to create a special needs trust in the name of your loved one.

When you consider what life will be like for your loved ones when you are not around to care for them, you may have serious concerns about family members who rely on you for the most care. You may have a child, a sibling, or even a cousin with a disability or other special needs. These needs may leave the person unable to adequately look after themselves. If you have been caring for a person with special needs, your death could lead to serious challenges for him or her, and your best option may be to create a special needs trust in the name of your loved one.

A Powerful Tool

Also known as a supplemental needs trust, a special needs trust is an instrument that places assets under the care of trustee to be utilized to help provide for a person with special needs. The most unique aspect of a special needs trust is that the funds contained in the trust are not considered to be "available assets" for the disabled individual, which means they cannot impact the person’s eligibility for Medicaid, Supplemental Security Income (SSI) and other income-based government programs.

Finding Hidden Assets After Your Divorce Is Finalized

When you are navigating the process of divorce, you and your spouse must be open and honest about your individual finances and those you share as a couple. Without both parties being forthcoming, you will not ever be able to divide your marital property as prescribed by Illinois law. Even the court will not be able to make such decisions without all of the necessary information.

When you are navigating the process of divorce, you and your spouse must be open and honest about your individual finances and those you share as a couple. Without both parties being forthcoming, you will not ever be able to divide your marital property as prescribed by Illinois law. Even the court will not be able to make such decisions without all of the necessary information.

Unfortunately, is not uncommon for one spouse to hide property and revenue streams in an effort to keep them away from the asset division process. While it may be possible to track down these assets before a judgment is entered, sometimes the property will remain hidden until the divorce has been finalized. If you have recently gotten divorced and you just found out that your ex was being deceptive during the process, you can still take action to remedy the situation.

Getting Your Divorce Reopened

The first step in addressing the issue of hidden assets after a divorce is to enlist the help of a qualified divorce lawyer. Your attorney can help you with filing a petition for relief from the judgment of divorce in its current form. Essentially, your petition will state that the judgment should be set aside and the case should be reopened in light of the newly discovered assets. It is much easier to have your case reopened within the first 30 days of the entry of the judgment, but the law allows your case to be reopened at any time if there is a sufficient reason to do so.

Important Estate Planning Tasks for Newlyweds

People can get uncomfortable when discussing the role finances play in how successful or fulfilling a marriage will be. However, the simple fact is that money is consistently found to be the number one cause of stress in marriages. Studies have even shown that couples arguing over finances is the top predictor of divorce. Marriage is a financial partnership as much as it is a romantic partnership. If you are tying the knot this summer or have recently wed, read on to learn the steps newlyweds should take to protect their financial future.

People can get uncomfortable when discussing the role finances play in how successful or fulfilling a marriage will be. However, the simple fact is that money is consistently found to be the number one cause of stress in marriages. Studies have even shown that couples arguing over finances is the top predictor of divorce. Marriage is a financial partnership as much as it is a romantic partnership. If you are tying the knot this summer or have recently wed, read on to learn the steps newlyweds should take to protect their financial future.

Update Beneficiary Designations

Getting married can be quite the challenging and chaotic undertaking. Between choosing the venue, inviting guests, hosting the reception, and finding places for all those wedding gifts, some newlywed couples forget that there are certain financial steps they should take as well. Many unmarried individuals have their parents chosen as beneficiaries on things like life insurance policies and retirement accounts. When those individuals get married, they will need to change the beneficiary to their new spouse—presuming they wish to do so, of course. If the beneficiary designation is not modified and a tragic accident occurs, the surviving spouse will not receive any of that life insurance policy's payout. After getting married, each spouse should review financial accounts such as 401ks, brokerage accounts, IRAs, and bank accounts and update beneficiary designations as needed.

Divorced Fathers in Illinois Have Little Parenting Time, According to Recent Study

Many studies have shown that children do best with both parents in their life. Of course, this is not true for situations involving abuse or domestic violence, but generally, removing one parent from a child’s life is damaging to the well-being of that child. Fortunately, many parents who get divorced or who never marry are able to work out a shared parenting arrangement which includes both parents as full participants in their children’s’ lives. Unfortunately, a new study shows that Illinois fathers are at the bottom of the list when it comes to how much time they spend with their children.

Many studies have shown that children do best with both parents in their life. Of course, this is not true for situations involving abuse or domestic violence, but generally, removing one parent from a child’s life is damaging to the well-being of that child. Fortunately, many parents who get divorced or who never marry are able to work out a shared parenting arrangement which includes both parents as full participants in their children’s’ lives. Unfortunately, a new study shows that Illinois fathers are at the bottom of the list when it comes to how much time they spend with their children.

Study Analyzes Shared Parenting Schedules Across the Country

The study, which was piloted by a software company that makes apps for divorced and separated parents, involved a compilation of data regarding the most common parenting time arrangements in each of the fifty states. Through a survey of legal professionals and judicial standards across the country, the researchers were able to calculate the average amount of time parents spend with their children. The study only included cases in which both parents wanted custody of their children, and there were no extenuating circumstances, such as long-distance separation or criminal convictions.

What to Expect if Your Loved One Dies Without a Will

The passing of a loved one is almost always a terrible ordeal to endure. When a relative passes without a will, the process of managing the deceased person’s final affairs only adds to the difficulty. A person who dies without a will is considered to have died “intestate.” Illinois intestacy laws determine how a person’s property and debt are distributed after their death when a valid will is not present.

The passing of a loved one is almost always a terrible ordeal to endure. When a relative passes without a will, the process of managing the deceased person’s final affairs only adds to the difficulty. A person who dies without a will is considered to have died “intestate.” Illinois intestacy laws determine how a person’s property and debt are distributed after their death when a valid will is not present.

Laws of Intestate Succession When No Valid Will Exists

The rules regarding how a deceased person’s property should be divided are largely dependent on the deceased person’s surviving relatives. When a single person with no children passes away, his or her estate will go to his or her parents or siblings. If that person does not have living parents or siblings, their estate will go to nieces and nephews or more distant relatives. If an unmarried person with children passes away, their estate will go to their children. If a married person passes away, their spouse will usually receive the part of the estate which is considered marital property. Unfortunately, unmarried couples do not have any legal right to their partner’s property if that partner passes away without a will.

What to Do If Your Spouse Is Purposely Wasting Assets During Your Divorce

Ideally, every divorcing couple would be cooperative and amicable during the divorce proceedings and the time leading up to it. However, this is not how a large number of divorces go. Spouses are often at least partially resentful of each other or harbor negative feelings about their soon-to-be-ex. In most instances, these hostile feelings only result in a few sideways glances or muttered insults between the spouses. In more extreme circumstances, one spouse may try to "get even" or hurt the other spouse through excessive spending or squandering marital property. This wastefulness is called "dissipation of assets," and Illinois courts take the matter very seriously.

Ideally, every divorcing couple would be cooperative and amicable during the divorce proceedings and the time leading up to it. However, this is not how a large number of divorces go. Spouses are often at least partially resentful of each other or harbor negative feelings about their soon-to-be-ex. In most instances, these hostile feelings only result in a few sideways glances or muttered insults between the spouses. In more extreme circumstances, one spouse may try to "get even" or hurt the other spouse through excessive spending or squandering marital property. This wastefulness is called "dissipation of assets," and Illinois courts take the matter very seriously.

What Exactly Does "Dissipation of Assets" Mean?

The concept of dissipation can be hard to understand. The formal definition of dissipation comes from the Illinois Supreme Court. Dissipation formally refers to "the use of marital property for the sole benefit of one of the spouses for a purpose unrelated to the marriage at a time that the marriage is undergoing an irretrievable breakdown." In order to know if your spouse is guilty of dissipation, you need to determine what property has been misspent. Generally, marital property includes any property or income which was accumulated by either spouse during the marriage. So, if a spouse wasted money from a bank account which was used for shared expenses like bills and household expenses, he may be guilty of dissipation.

The Allocation of Parental Responsibilities in Illinois

Most of us are familiar with at least the basic concept of child custody. In most instances, we realize that the phrase refers to making arrangements for raising a child or children following a divorce or breakup between the parents. While it is possible for non-parents to gain custody of a child, the vast majority of child custody disputes are between a child’s biological parents.

Most of us are familiar with at least the basic concept of child custody. In most instances, we realize that the phrase refers to making arrangements for raising a child or children following a divorce or breakup between the parents. While it is possible for non-parents to gain custody of a child, the vast majority of child custody disputes are between a child’s biological parents.

In 2016, sweeping reforms to the family law statutes in Illinois eliminated the official use of the phrase “child custody.” The amendments introduced new terminology that was intended to be less divisive and more cooperative. For many years, parents sought to “win” custody of their children, rather than working together to find the best possible parenting arrangement. Today, the legal concept of child custody in Illinois is known as the allocation of parental responsibilities.

Two Primary Components

How a Divorce Can Affect Your Estate Plan, Part 4: Beneficiary Designations

The American Stress Institute has named divorce as the second-most stressful event a person can endure. Ending a marriage is considered even more stressful than losing your job or going to jail. Of course, the emotional toll that comes with ending a serious relationship is a big part of this stress, but the logistics and paperwork required to properly divorce can sometimes be even more stressful. This is one reason A. Traub & Associates is dedicated to helping clients adjust their estate plans after a divorce. In this final post of a four-part series about how divorce will affect your estate plan, we will discuss updating beneficiaries after a divorce.

The American Stress Institute has named divorce as the second-most stressful event a person can endure. Ending a marriage is considered even more stressful than losing your job or going to jail. Of course, the emotional toll that comes with ending a serious relationship is a big part of this stress, but the logistics and paperwork required to properly divorce can sometimes be even more stressful. This is one reason A. Traub & Associates is dedicated to helping clients adjust their estate plans after a divorce. In this final post of a four-part series about how divorce will affect your estate plan, we will discuss updating beneficiaries after a divorce.

Estate Planning Housekeeping for Those Getting Divorced

In the last few posts, we discussed updating wills, trusts, and powers of attorney after a divorce. In addition to these tasks, divorcing individuals should make sure to update documents that designate beneficiaries for things like insurance policies, pensions, and retirement plans. If you are like most people, you probably named your spouse as the primary beneficiary of many policies and accounts. Some individuals assume that when a person divorces, these beneficiary designations automatically change. However, this is not the case. If you are getting a divorce and do not want your soon-to-be-ex-spouse to be a beneficiary anymore, you are responsible for making these changes.

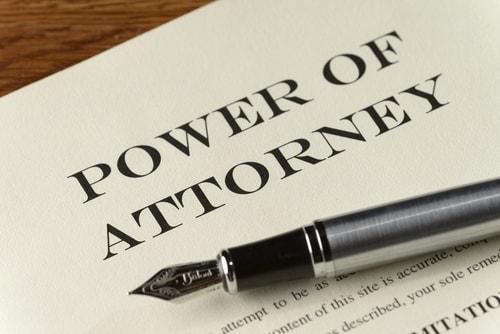

How a Divorce Can Affect Your Estate Plan, Part 3: Powers of Attorney

Over the last couple of weeks, posts on this blog have discussed how your estate plan could be affected by a divorce. The first post covered your will while the second post talked about the impact of a divorce on certain types of trusts. While wills and trusts are two of the most common estate planning tools, there are others that might need to be updated if you decide to get divorced, including powers of attorney for property or health care.

Over the last couple of weeks, posts on this blog have discussed how your estate plan could be affected by a divorce. The first post covered your will while the second post talked about the impact of a divorce on certain types of trusts. While wills and trusts are two of the most common estate planning tools, there are others that might need to be updated if you decide to get divorced, including powers of attorney for property or health care.

Powers of Attorney

A power of attorney refers to an arrangement in which a person—called the "principal"—gives legal authority to another person—called an "attorney in fact" or an "agent—to make decision on the principal’s behalf. A power of attorney can include a wide range of decision-making responsibilities, but there are two basic types. A power of attorney for property gives the agent the authority to make decisions regarding the principal’s assets, debts, and other property, while a power of attorney for health care allows the agent to act on the principal’s behalf in matters related to health and medical care.