Recent Blog Posts

Avoiding Financial Mistakes During and After Divorce

When your marriage is ending, your life will likely be thrown into chaos as you and your spouse work to separate the many aspects of your lives which have become closely linked over the years of your partnership. During divorce, it is important to understand how your finances will be affected and plan for how you will manage your ongoing budget.

When your marriage is ending, your life will likely be thrown into chaos as you and your spouse work to separate the many aspects of your lives which have become closely linked over the years of your partnership. During divorce, it is important to understand how your finances will be affected and plan for how you will manage your ongoing budget.

Consider the following tips to get on the right financial foot during divorce proceedings and after your divorce has been finalized:

-

Create a budget - You should make sure you have a full understanding of your income and expenses, including any spousal maintenance or child support payments you pay or receive after the divorce. Additionally, be sure you are accounting for rent, utilities, groceries, credit card bills, vehicle maintenance costs, insurance, and child care costs. Setting everything down in a budget and planning month to month management will ensure that unexpected costs do not arise and cause problems in the future.

Preparing Your Home for Comfortable, Safe Aging

When most people think about estate planning, they often focus the transfer of assets from one generation to the next. Wills and trusts-the most common vehicles for transferring such assets-represent a significant part of the estate planning process, but there are many other considerations that should be addressed. One of the most often overlooked aspects of estate planning is preparing yourself and your home to make life easier as you age, and doing so often takes time, money, and self-awareness regarding your current and possible limitations.

When most people think about estate planning, they often focus the transfer of assets from one generation to the next. Wills and trusts-the most common vehicles for transferring such assets-represent a significant part of the estate planning process, but there are many other considerations that should be addressed. One of the most often overlooked aspects of estate planning is preparing yourself and your home to make life easier as you age, and doing so often takes time, money, and self-awareness regarding your current and possible limitations.

A Glaring Need

According to the Pew Research Center, an estimated 12 million Americans over the age of 65 live alone. A disproportionate 69 percent of that number-nearly 8.3 million-are women. While independence among senior citizens is often a desirable alternative to assisted living or nursing facilities, the reality is that a home that is suitable for a healthy, able-bodied adult may not be convenient or safe for an aging senior.

Unique Considerations in a Military Divorce

Divorce is extremely common, and sometimes, it can come at an inopportune time. Nowhere is this more apparent than in the case of military families, when essentially, there is no “good” time unless the person with a military career is essentially retired. To help military couples obtain a divorce in an amicable fashion without having to wait years, there are certain specific divorce laws that apply only to them.

Divorce is extremely common, and sometimes, it can come at an inopportune time. Nowhere is this more apparent than in the case of military families, when essentially, there is no “good” time unless the person with a military career is essentially retired. To help military couples obtain a divorce in an amicable fashion without having to wait years, there are certain specific divorce laws that apply only to them.

Service and Timing Issues

The main issues in trying to obtain a divorce from an active duty military member are personal service and the possibility of default. A divorce can be filed in Illinois if one or both spouses either live in state permanently, or if one or both spouses are stationed in the state. However, in any contested divorce, the non-moving party must be served personally with a copy of the petition filed by their spouse. Otherwise the court, in theory, has no jurisdiction over them. In other words, without personal service, the military member would not have enough contact with the place where the court is for that court to have any power over him or her. If the divorce is not contested, personal service may be waived, but if it is contested, the rule is absolute. This means that the personal service requirement can make going forward with the divorce very difficult if the military member is overseas or in a war zone.

Second Parent Adoption

Same-sex marriage is now legal in all 50 states, with all the attendant rights and responsibilities that marriage entails. Parenting for same-sex couples can be tricky, however, as certain legal issues are likely to arise. Fortunately, the state of Illinois has measures in place to help same-sex parents obtain and exercise parental rights in variety of situations. One such option is a second parent adoption, or SPA.

Same-sex marriage is now legal in all 50 states, with all the attendant rights and responsibilities that marriage entails. Parenting for same-sex couples can be tricky, however, as certain legal issues are likely to arise. Fortunately, the state of Illinois has measures in place to help same-sex parents obtain and exercise parental rights in variety of situations. One such option is a second parent adoption, or SPA.

SPA Defined

Second parent adoption is defined as an adoption in which a second parent may adopt a child without the first losing any parental rights. Normally, adoptions require a parent to renounce his or her parental rights-or to have them terminated-in favor of another caregiver, but SPA allows both caregivers to have legal rights regarding the child.

This can be critical in the case of something like a change in the law, or an accident that leaves one parent or the child incapacitated in some way. If both halves of the couple are the legal parents of the child, it can prevent most potential battles over competence and jurisdiction. For example, if only a child’s biological mother is their legal parent, the mother’s same-sex partner has no legal authority to make decisions for the child. In extreme circumstances, this could even lead to the child being removed from their home if the legal parent is deceased or disabled.

Collaborative Divorce and the Illinois Collaborative Process Act

In our modern society, divorce is often unavoidable. But while divorcing couples will need to resolve issues such as the division of assets and debts and the allocation of parental responsibility, reaching a decision on these matters does not have to be contentious.

In our modern society, divorce is often unavoidable. But while divorcing couples will need to resolve issues such as the division of assets and debts and the allocation of parental responsibility, reaching a decision on these matters does not have to be contentious.

By using methods of alternative dispute resolution, couples can settle the outstanding issues in their divorce while avoiding costly litigation.

One of the best ways divorcing couples can work together to reach a settlement is through collaborative divorce (also known as collaborative law). This practice has become more common in recent years, and it has been formally recognized in the state of Illinois through the Illinois Collaborative Process Act, which Governor Bruce Rauner signed into law in August 2017 and which goes into effect on January 1, 2018.

Estate Planning and the Five Stages of Grief

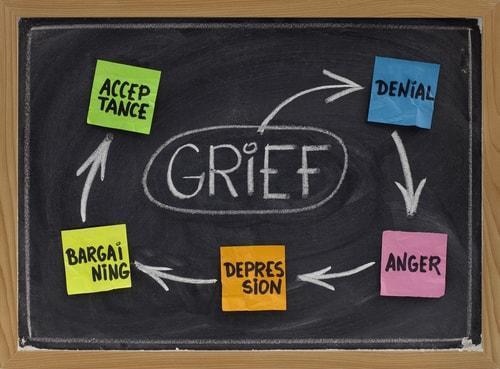

Most people are familiar with the concept of different “stages of grief.” While you may not necessarily be able to list the five stages as they were introduced in 1969, you are most likely aware that grieving, for most people, is a process with fairly distinct elements. While there are other situations that could cause a person to go through the grieving process-such as a divorce or giving a child up for adoption-the most common is during the period following the death of a loved one. When you die, your children, grandchildren, and other family members will almost certainly experience a great deal of grief, which makes responsible estate planning all the more important.

Most people are familiar with the concept of different “stages of grief.” While you may not necessarily be able to list the five stages as they were introduced in 1969, you are most likely aware that grieving, for most people, is a process with fairly distinct elements. While there are other situations that could cause a person to go through the grieving process-such as a divorce or giving a child up for adoption-the most common is during the period following the death of a loved one. When you die, your children, grandchildren, and other family members will almost certainly experience a great deal of grief, which makes responsible estate planning all the more important.

What Are the Five Stages?

In 1969, a Swiss-American psychiatrist named Elisabeth Kubler-Ross published a book called "On Death and Dying" which introduced the stages of grief as she saw them. Based on her experience and study, she identified the five stages as Denial, Anger, Bargaining, Depression, and Acceptance. Despite being laid out as linear-suggesting that one stage leads into the next-the reality is much more complicated. A person who is largely in the Anger stage of grief is likely to experience moments or days of Denial and Depression. He or she may even skip a stage and effectively come back to it at a later point.

Paying For Children’s College Expenses After Divorce

Divorce can cause a great deal of financial upheaval in a couple’s lives, and as parents seek to restructure their finances following the end of their marriage, they will need to continue to provide for their children.

Divorce can cause a great deal of financial upheaval in a couple’s lives, and as parents seek to restructure their finances following the end of their marriage, they will need to continue to provide for their children.

One financial aspect of divorce that parents sometimes neglect is how to pay for their children’s college expenses, especially if they divorce when their children are still young and college is several years in the future.

However, as college approaches, and families begin the process of applying for financial aid, they can take certain steps to ensure that children will be able to receive a college education without breaking the bank:

-

Determine the information to use on financial aid forms - When filling out the Free Application for Federal Student Aid (FAFSA) form, students will need to identify their custodial parent. Even if parents share joint custody, only one parent can be identified, and this should be the parent who the student lived with the most during the previous year. If parenting time was equal during that time, the custodial parent is the parent who provided the most financial support to the child. If the custodial parent has remarried, their spouse should also be listed on the FAFSA.

Understanding the Factors That Affect Spousal Maintenance

When a couple ends their marriage in divorce, each spouse should be able to maintain a standard of living similar to what they experienced during their marriage. When one spouse earns more than the other, the lower earning spouse may be eligible to receive spousal maintenance (also known as spousal support or alimony).

When a couple ends their marriage in divorce, each spouse should be able to maintain a standard of living similar to what they experienced during their marriage. When one spouse earns more than the other, the lower earning spouse may be eligible to receive spousal maintenance (also known as spousal support or alimony).

While the formula for determining the amount and duration of maintenance is straightforward, courts have some discretion when determining whether maintenance is appropriate.

Illinois statutes list 14 factors that a judge should consider when deciding whether to grant maintenance:

1. The income and property of each party - The court will determine both spouses’ net income by calculating gross income from sources including wages or salary, disability benefits, retirement benefits, social security benefits, insurance proceeds, interest earned, and monetary gifts, then deducting expenses including taxes, social security payments, prior support or maintenance obligations, union dues, and medical expenses.

What Is Divorce By Publication?

Most of the time, when two people want to get divorced, they simply inform the other person by having a copy of the papers served upon them, usually by hand delivery. However, there are some very rare situations when the spouse cannot be located. When that happens, a suitable alternative must be found. The answer in Illinois and many other states is called divorce by publication.

Most of the time, when two people want to get divorced, they simply inform the other person by having a copy of the papers served upon them, usually by hand delivery. However, there are some very rare situations when the spouse cannot be located. When that happens, a suitable alternative must be found. The answer in Illinois and many other states is called divorce by publication.

A “Good Faith Search”

In all cases, your soon-to-be-ex-spouse must be informed of your desire and intention to file for divorce. However, if they have moved or are trying to avoid you and have left no forwarding address, the normal methods of mail or hand delivery are impossible. Yet it is contradictory to public policy to demand that two people remain married when they are not even living together and all communication has broken down. Publication is generally the best possible chance for your information to reach your absent spouse.

Communication Is Key in Estate Planning

Do you have a signed and executed will or any other elements of an estate plan in place? If so, you are already ahead of more than half of American adults.

Do you have a signed and executed will or any other elements of an estate plan in place? If so, you are already ahead of more than half of American adults.

Next question: Have you had in-depth discussions about estate planning with your children and other important family members? If so, you and your family are well prepared for unexpected surprises-assuming your estate plan addresses all or most of the details that are significant to you and your loved ones.

Final question: Would your children agree that you have had the necessary conversations and do they know where to find important documents, passwords, and account information? Unfortunately, serious disconnects in communication are all too common when it comes to estate planning.

A Relevant Study

Earlier this year, Fidelity Investments released a study showing that aging parents and their adult children are often on different pages in regard to important estate planning conversations. The survey indicated that nearly 70 percent of parents believed that they had talked at length with their children about wills, estate plans, and finances. More than half of their children, however, said that the conversations had not happened-at least not in sufficient detail.